As the NBA offseason descends, the whispers of lucrative contracts and blockbuster moves fill the air. Yet, beneath the surface of projected mega-deals lies a stark financial reality. The 2025 NBA Free Agency isn`t merely a talent grab; it`s a high-stakes poker game dictated by an unprecedented scarcity of cap space. For many of the league`s top stars, securing their next contract requires more than just elite performance—it demands strategic nuance, financial flexibility, and a willingness to play by the market`s constrained rules.

- The Uncommon Landscape: A Buyer`s Market for One

- Crafting the Compromise: The Art of the “Win-Win” Deal

- Stars Under the Microscope: Navigating Personal Ambition and Market Reality

- James Harden: The Veteran`s Gambit

- Kyrie Irving: Balancing Risk and Reward

- Julius Randle: Performance Peaks and Financial Plateaus

- Josh Giddey & Jonathan Kuminga: The Restricted Advantage

- Ty Jerome: The Sixth Man`s Ascent

- The Luxury Tax and Second Apron: The True Obstacles

- The Strategic Game Continues

The Uncommon Landscape: A Buyer`s Market for One

Forget the free-spending days of yesteryear. The 2025 free agency class is navigating a market unlike many before it. The primary antagonist? A severe lack of salary cap space across the league. While the Brooklyn Nets stand as the sole exception, possessing the financial runway to offer contracts exceeding $30 million, the vast majority of teams are tethered by the $14.1 million non-tax midlevel exception. This isn`t just a minor inconvenience; it`s a fundamental reshaping of how deals are structured and what players can realistically expect.

This financial bottleneck transforms what should be a straightforward negotiation into a complex dance. Players, traditionally seeking maximum value and long-term security, now face a landscape where even star-level talent might need to compromise on initial salary, tenure, or guarantee structures. For teams, it`s about retaining key assets without plunging into the punitive depths of the luxury tax and the dreaded second apron, which impose severe restrictions on future team-building.

Crafting the Compromise: The Art of the “Win-Win” Deal

Given the tight market, both players and teams are compelled to get creative. The era of straightforward max contracts for every deserving player is, for now, on pause. Instead, we are witnessing an intriguing evolution of contract architecture:

- Player Options: While seemingly a player`s prerogative, these can be a strategic concession, allowing players to bet on their future performance or a more favorable market.

- Team Options: A team`s ultimate flexibility tool, providing an escape hatch if a player`s performance declines or if future cap space becomes paramount.

- Partial Guarantees & Incentives: A true shared risk. Teams reduce their financial exposure, while players can unlock additional earnings based on individual achievements (e.g., All-Star nods, defensive honors) or, more often, collective team success (e.g., reaching conference finals, NBA Finals). It’s a delicate balance: reward performance without overcommitting to potential decline.

- Front-Loaded vs. Back-Loaded Deals: The traditional wisdom of salary progression is often inverted to manage immediate cap implications, allowing teams to stay below tax thresholds in critical years.

These mechanisms are not just footnotes in a contract; they are the very scaffolding upon which deals are built in this constrained environment. The “win-win” isn`t always about both sides getting everything they want, but rather about reaching a mutually agreeable outcome that, crucially, makes financial sense within the current NBA ecosystem.

Stars Under the Microscope: Navigating Personal Ambition and Market Reality

Let`s examine some of the prominent names on the 2025 free agent list and the unique challenges and opportunities their situations present:

James Harden: The Veteran`s Gambit

LA Clippers | Guard

James Harden, fresh off an All-Star and All-NBA season, finds himself at a fascinating crossroads. At 37, his age, combined with the Clippers` desire for future financial flexibility, means a traditional max contract is unlikely. The proposed two-year, $79 million deal with performance-based guarantees in the second year is a masterclass in market adaptation. It’s a raise, certainly, but structured to incentivize deep playoff runs—a brilliant psychological ploy by the Clippers, tying his pay directly to the team`s ultimate goal. It offers Harden a comfortable short-term deal while allowing the team to manage their cap for the crucial 2026 offseason, which is as much a chess move as it is a contract offer.

Kyrie Irving: Balancing Risk and Reward

Dallas Mavericks | Guard

Kyrie Irving`s situation with the Mavericks highlights the tension between a player`s option and a team`s need for flexibility. Opting out of a higher salary ($43 million) to sign a three-year, $113 million deal seems counter-intuitive at first glance. However, by accepting a lower initial salary, Irving provides Dallas with critical cap relief, granting them access to exceptions that were previously unavailable. It`s a calculated gamble, with Irving securing guaranteed long-term money and the Mavericks gaining immediate maneuverability to bolster their roster. His recent injury adds another layer of complexity, but the commitment signals mutual trust in the partnership`s future.

Julius Randle: Performance Peaks and Financial Plateaus

Minnesota Timberwolves | Forward

Julius Randle`s case is a prime example of a player seeking security despite a challenging market. Declining a $30.9 million player option in a market devoid of significant cap space is a bold move. The proposed four-year, $121 million deal from Minnesota, with a contingent fourth year tied to an NBA Finals appearance, perfectly illustrates the strategic use of incentives. The Timberwolves save $4 million in the first year by replacing his option salary, a small but crucial sum that helps retain key reserves like Naz Reid and Nickeil Alexander-Walker while staying clear of the second apron. It`s a testament to how even modest savings can have profound ripple effects on team construction.

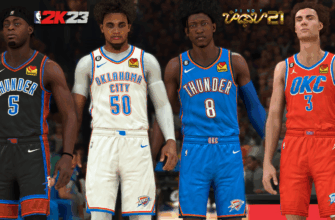

Josh Giddey & Jonathan Kuminga: The Restricted Advantage

Chicago Bulls (Giddey), Golden State Warriors (Kuminga) | Guards/Forwards

For young talents like Josh Giddey and Jonathan Kuminga, restricted free agency is less about freedom and more about team control. While Giddey`s statistical output merits a significant raise (e.g., five years, $125 million from Chicago), the Bulls hold significant leverage. With only Brooklyn able to make a substantial offer sheet, Chicago can likely secure Giddey at a price below what an open market might command. Kuminga`s situation is even more fluid, given his inconsistent role. Golden State`s ability to match any offer ensures they dictate the terms, even as they project his long-term value. This mechanism underscores how teams can `lock in` promising young players, regardless of their immediate consistency, by simply holding the matching card.

Ty Jerome: The Sixth Man`s Ascent

Cleveland Cavaliers | Guard

Even for non-superstars, the financial constraints loom large. Ty Jerome, a valuable backup guard, expects a significant raise from his $2.6 million salary. While Cleveland can offer the most money ($64 million over four years), their existing luxury tax situation and position over the second apron make a full commitment financially punitive. A $14 million starting salary could trigger an additional $80 million in tax penalties. This opens the door for teams with midlevel exceptions, such as Atlanta, Brooklyn, Charlotte, or Sacramento, to present competitive offers. Jerome`s decision will highlight the direct trade-off between higher guaranteed money from his current team and a potentially more financially palatable (for the team) but still lucrative deal elsewhere.

The Luxury Tax and Second Apron: The True Obstacles

Beyond the simple absence of cap space, the revised Collective Bargaining Agreement (CBA) and its luxury tax penalties are casting long shadows over free agency. Teams previously willing to dip into the tax are now hyper-aware of the steep financial and roster-building consequences. The “second apron” in particular creates a hard cap on spending and transactional flexibility, forcing front offices to make difficult choices about retaining talent versus maintaining future maneuverability.

The Pacers, for instance, despite not having paid luxury tax since 2005-06, are reportedly willing to do so for Myles Turner. Yet, every dollar spent above the tax line is magnified by punitive penalties. This pressure directly influences contract offers, turning even seemingly straightforward re-signings into strategic puzzles. The stakes are no longer just about winning on the court; they`re about winning the financial game, too.

The Strategic Game Continues

The 2025 NBA Free Agency is proving to be a masterclass in strategic negotiation. It`s a period where the traditional allure of “freedom” for players is met with the unyielding “reality” of a tight financial market. Teams are forced to be innovative with contract structures, leveraging player and team options, incentives, and partial guarantees to retain talent without crippling their future flexibility or incurring catastrophic tax bills. For the players, it’s about balancing ambition with pragmatism, understanding that the biggest deal isn`t always the one with the highest annual value, but the one that aligns best with their career stage and the market`s prevailing winds. This summer, the true winners will be those who navigate this financial labyrinth with the shrewdest moves, proving that in the NBA, financial strategy is just as crucial as on-court prowess.