In the high-stakes world where professional sports meet high finance, scandals are not entirely unfamiliar. Yet, few stories intertwine the ambitious promise of “socially conscious” banking with the cutthroat competition of the NBA quite like the saga of Aspiration, the LA Clippers, and star player Kawhi Leonard. What began as a mission to “do well by doing good” has devolved into a sprawling investigation, allegations of corporate fraud, and a complex narrative involving millions of dollars, celebrity endorsements, and the formidable power of the NBA`s salary cap rules.

Aspiration: The Rise of a Green Vision

Founded in 2013 by Harvard alumni Joe Sanberg, a savvy entrepreneur, and Andrei Cherny, a lawyer with White House experience, Aspiration Partners emerged with a compelling vision: to offer banking and investment services that were not just profitable, but also ethically sound. Their rallying cry, “Do Well. Do Good,” encapsulated a promise to distance customer deposits from fossil fuel projects and to promote sustainable investing. It was, ostensibly, a digital bank for the environmentally conscious, offering perks like cash back for “doing the right thing” and even planting a tree with every purchase roundup.

This enticing blend of profit and purpose quickly attracted significant attention. The company`s roster of investors read like a Hollywood guest list, featuring names such as Robert Downey Jr., Leonardo DiCaprio, Orlando Bloom, and even NBA figures like now-Milwaukee Bucks coach Doc Rivers. Corporate giants like Meta and Microsoft also became partners, lending considerable legitimacy to Aspiration`s “green” credentials. For a time, Aspiration seemed to embody the perfect synergy of modern finance and social responsibility, riding the wave of growing demand for ethical consumerism.

The Clippers Connection: A Partnership Forged in Ambition

Enter Steve Ballmer, the impassioned owner of the LA Clippers and a billionaire known for his philanthropic endeavors, particularly in climate initiatives. In September 2021, Ballmer personally invested a reported $50 million into Aspiration. This significant backing paved the way for a monumental partnership between Aspiration and the LA Clippers, a $300 million deal that would see Aspiration become the “first founding partner” of the new Intuit Dome, the Clippers` state-of-the-art arena. The partnership was lauded as a commitment to sustainability, complete with a “Planet Protection Fund” designed to offset fans` carbon footprints.

“Aspiration becoming our first Founding Partner supports the stake we are planting in the ground to make Intuit Dome the most sustainable arena in the world,” Ballmer declared at the time.

On the surface, it appeared to be a mutually beneficial arrangement: Aspiration gained massive exposure and credibility through a high-profile sports team, while the Clippers burnished their image as leaders in environmental responsibility. What could possibly go wrong?

The $28 Million Endorsement: A Troubling Alliance?

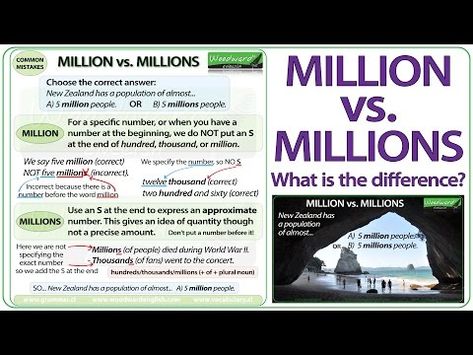

The plot thickened in November 2021 when Ballmer reportedly introduced Aspiration to Kawhi Leonard, the Clippers` star forward. Just nine months after Leonard re-signed with the Clippers, his LLC, KL2 Aspire, allegedly inked a four-year, $28 million endorsement deal with Aspiration in April 2022. This timing and the substantial sum immediately raised eyebrows, especially when an unnamed Aspiration employee reportedly suggested the payment was intended to “circumvent the salary cap.”

The NBA, ever vigilant about maintaining competitive balance, promptly launched an investigation into whether Ballmer and the Clippers violated league rules. Commissioner Adam Silver emphasized the league`s burden to prove wrongdoing, stating a reluctance to act on “mere appearance of impropriety.” However, further reports emerged, linking Clippers minority owner Dennis Wong to a nearly $2 million investment in Aspiration just days before Leonard received a significant payment from the company. These converging lines of inquiry painted a picture far more complicated than a simple celebrity endorsement.

The Unraveling: From Green to Red

While the NBA`s investigation unfolded, Aspiration itself began to crumble. Co-founder and CEO Andrei Cherny departed in 2022, later stating that Leonard`s contract was legitimate and involved “extensive obligations.” However, he couldn`t speak to what happened after his departure. The company, once a beacon of ethical finance, filed for bankruptcy in March, saddled with a staggering $170 million in debt. Among its creditors, the Clippers were owed $30 million, and Leonard`s LLC was owed $7 million.

The final, damning blow came last month when co-founder Joe Sanberg pleaded guilty to two counts of wire fraud. Federal prosecutors alleged Sanberg defrauded investors and lenders of $248 million through falsified statements and concealed revenue. The “Do Well. Do Good.” slogan now echoed with an unsettling irony, revealing a foundation built on deceit.

Ballmer, who had initially championed Aspiration, expressed his embarrassment and a sense of betrayal. “These were guys who committed fraud. Look, they conned me,” he admitted, denying any foreknowledge of the alleged scheme with Leonard. He portrayed himself as another victim in a sophisticated deception.

The Aspiration saga serves as a potent reminder of the complexities at the intersection of business, ethics, and sports. It highlights the immense pressure on sports franchises to remain competitive, the allure of “green” investments, and the critical importance of due diligence. As the NBA`s investigation continues, the broader implications for transparency, corporate governance, and the integrity of professional sports leagues remain stark. The story of Aspiration is not just about a bank that failed, but about a grand ambition that collapsed under the weight of alleged fraud, leaving a trail of financial wreckage and a significant question mark over a major NBA franchise.