The NBA offseason is officially underway, and teams are actively shaping their rosters for the 2025-26 season. Several significant moves have already been made, setting the stage for what`s to come.

Kyrie Irving, recovering from a torn ACL sustained during the regular season, chose to decline his player option with the Dallas Mavericks and is expected to sign a three-year contract extension. Meanwhile, the Houston Rockets, fresh off acquiring Kevin Durant in a major trade before the offseason began, kicked things off by agreeing to a three-year, $39 million contract extension with center Steven Adams. This extension follows a strong season where Adams served effectively as the backup center for the Western Conference`s second seed.

With the NBA draft concluded and free agency rapidly approaching (set to open Monday at 6 p.m. ET), signings are anticipated to occur frequently and quickly. As deals become official, this analysis will provide grades and examine the implications of each move for the upcoming 2025-26 season and the future.

- June 29: LeBron picks up $52.6M option

- June 29: Jaylin Williams to sign new three-year deal with OKC

- June 28: Mitchell returns to Miami on two-year deal

- June 28: Merrill gets new deal with Cleveland

- June 27: Timberwolves and Naz Reid agree to new deal

- June 25: VanVleet to sign new $50 million deal with Houston

- June 24: Kyrie Irving declines player option

- June 23: Mavs` Gafford gets three-year extension

- June 14: Rockets, Adams agree to three-year extension

June 29: LeBron picks up $52.6M option

![]()

Grade: N/A

Los Angeles Lakers forward LeBron James has exercised his $52.6 million player option for the 2025-26 season. At first glance, this move, especially alongside reports of him contemplating his future outside of Los Angeles, seems counterintuitive – why opt in if he might want to leave?

The explanation lies in the current market. This year’s free agency is largely devoid of teams with significant cap space. The rebuilding Brooklyn Nets are practically the only team that could offer James a salary near his maximum as a free agent. Therefore, if James were to change teams this summer, a trade is the far more probable scenario.

While a sign-and-trade is technically possible if James had declined his option, it comes with complications. A team acquiring a player via sign-and-trade is immediately hard-capped at the lower luxury-tax apron, severely limiting their ability to build the rest of the roster. An opt-in and trade avoids these particular restrictions. For instance, hypothetically, the Golden State Warriors could trade Jimmy Butler III and Bronny James to the Lakers for LeBron James, and neither team would face a hard cap, allowing the Warriors to re-sign restricted free agent Jonathan Kuminga, for example.

James`s decision to set his cap number clarifies the Lakers’ options in free agency. The team is essentially faced with a choice: either re-sign forward Dorian Finney-Smith (who plans to decline his $15.4 million player option for a longer contract) or utilize the $14.1 million non-taxpayer midlevel exception, presumably to sign a starting center. Opting for the latter route would hard-cap the Lakers at the lower apron, requiring them to fill out the remaining roster spots with minimum contracts while maintaining minimal flexibility for in-season trades.

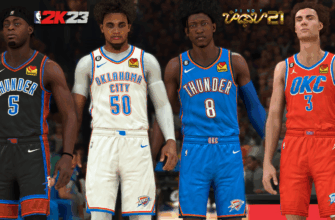

June 29: Jaylin Williams to sign new three-year deal with OKC

![]()

Grade: B+

The Oklahoma City Thunder have reportedly agreed to re-sign center Jaylin Williams to a three-year, $24 million contract. This agreement is the latest example of the Thunder’s strategic contract management, aimed at maximizing spending now to gain greater flexibility in the future as extensions for key starters like Shai Gilgeous-Alexander, Chet Holmgren, and Jalen Williams come into play. These upcoming deals represent the primary remaining financial business for the reigning champions, who currently have a full roster.

Considering Oklahoma City held a $2.2 million team option for Jaylin Williams’ 2025-26 salary, this deal effectively functions as a two-year extension worth $22 million. By declining the team option and beginning the new contract immediately, the Thunder can structure the deal to provide Williams with the largest portion of the total salary this season.

Starting the contract at its highest point and decreasing salaries in subsequent years is expected to keep Oklahoma City just below the luxury-tax threshold, especially following the recent trade that sent a 2024 first-round pick to the Washington Wizards to clear a roster spot and reduce salary. This assumes the Thunder exercise a $3 million team option on guard Ajay Mitchell. Mitchell is in a different contractual situation as he will still be a restricted free agent next summer, whereas Jaylin Williams would have been unrestricted.

Despite not being a fixture in the Thunder`s rotation during the final two rounds of the playoffs, Williams has proven to be a reliable center option. He took on a significant role during much of the regular season when starters were unavailable, demonstrating his capabilities. Williams recorded three triple-doubles in nine starts, averaging 10.0 points, 8.0 rebounds, and 4.9 assists in those games. He has the potential to become a consistent rotation player down the line, particularly if Oklahoma City is forced to move on from Isaiah Hartenstein for financial reasons, as Hartenstein’s $28.5 million salary for 2026-27 includes a team option.

June 28: Mitchell returns to Miami on two-year deal

![]()

Grade: B

Davion Mitchell has reportedly agreed to re-sign with the Miami Heat on a two-year, $24 million deal. By surpassing 2,000 minutes played and meeting “starter criteria” last season, Mitchell was in a strong negotiating position as a restricted free agent. Due to the starter criteria, his qualifying offer was $9.4 million, the second-highest among restricted free agents. Even without a strong market developing, playing the 2025-26 season on the qualifying offer and becoming an unrestricted free agent the following summer was a viable option.

Instead, Mitchell and the Heat agreed on a contract that guarantees him more money upfront while keeping him under contract for two years. This structure also means he can be included in a trade during this period without requiring his consent.

Mitchell could prove to be a bargain if he maintains the improved shooting he displayed after joining the Heat at the trade deadline. Historically a 34% career 3-point shooter, Mitchell shot an impressive 45% from deep with Miami and 7-of-14 in the playoffs. His performance earned him a starting role, averaging 31.6 minutes per game post-trade.

Known as `Off Night` for his defensive prowess against opposing guards, Mitchell has consistently been an elite point-of-attack defender. However, his offensive limitations previously confined him to a reserve role during his three seasons with the Sacramento Kings, who traded him a year ago to save salary.

It`s wise to be cautious about extrapolating too much from a relatively small sample size of roughly 100 3-point attempts. Nevertheless, the Heat have a history of successfully developing players who weren`t considered strong shooters. This contract provides Miami with two more years to determine if Mitchell`s offensive progress is legitimate and if he can be a long-term starting guard for the team.

With Mitchell re-signed, the Heat are approaching the lower luxury-tax apron. However, they retain the ability to dip back under the tax line by potentially waiving forward Duncan Robinson. Assuming Robinson does not exercise an early termination option to test free agency, he is under contract for $19.9 million next season, though only $9.9 million of his 2026-27 salary is guaranteed.

June 28: Merrill gets new deal with Cleveland

![]()

Grade: B

After playing a mere 350 minutes across his first three NBA seasons with three different teams, Sam Merrill has established himself as an important piece of Cleveland’s effective bench units over the past two seasons. Always recognized as a premier shooter, Merrill has hit 39% of his career 3-point attempts, significantly increasing his volume with the Cavaliers – 11.9 attempts per 36 minutes in 2023-24 and 9.5 last season.

Despite not having ideal physical tools for defense, Merrill has proven to be a better defender than he appears. He maintained a crucial spot in the rotation during Cleveland`s second-round playoff series against the Indiana Pacers when Darius Garland was sidelined, until a neck strain kept him out of the deciding Game 5.

Previously on a minimum contract, Merrill had certainly earned a substantial raise. Given the Cavaliers were already $10 million over the second luxury tax apron after the Lonzo Ball trade, with only 10 players under NBA contract, re-signing Merrill likely necessitated choosing between him and fellow valuable reserve Ty Jerome. It`s probable that Merrill`s new contract will have a lower annual value than Jerome’s potential market, which might be near the non-taxpayer midlevel exception.

Committing to Merrill for four years carries some inherent risk. Drafted at age 24 after serving a Latter-day Saints mission before his college career, Merrill recently turned 29, meaning this contract will extend well into his 30s. While his shooting ability is expected to remain consistent, his defensive effectiveness could potentially decline over time.

Given Cleveland’s limitations due to the second apron, finding a replacement for Merrill at his production level would have been challenging. This signing allows the team to plan within a two-year window of significant spending before needing to adjust financially when several contracts expire after the 2026-27 season. In this context, signing Merrill to a contract with a lower starting salary but a larger total amount over four years likely represented the most sensible approach for the Cavaliers.

June 27: Timberwolves and Naz Reid agree to new deal

![]()

Grade: C-

In what appeared to be a challenging market for free agents, Naz Reid managed to find leverage to secure an incredibly favorable contract, reportedly agreeing to a five-year, $125 million deal with the Minnesota Timberwolves. This deal now presents a financial challenge for the Timberwolves as they also need to address the contracts of starting forward Julius Randle (who, like Reid, holds a player option for 2025-26) and reserve guard Nickeil Alexander-Walker. Minnesota faces difficult decisions about which players to prioritize financially, starting with compensating Reid at a level typically associated with a starting-caliber player throughout the duration of his new contract.

This situation is particularly interesting because only one other team (the Brooklyn Nets) possessed the cap space to potentially match such an offer for Reid. Furthermore, there is no clear path for Reid to become a starter in the immediate future, especially if the Timberwolves manage to retain Randle. Assuming the Nets were not seriously interested, Reid’s market was presumably closer to the $14.1 million non-taxpayer midlevel exception. That would have resulted in a maximum contract value of $60.6 million over four years, significantly less than Minnesota offered. Reid also had the option of exercising his $15 million player option for 2025-26 and testing the free-agent market the following summer, a scenario that, from the Timberwolves` perspective, should have been viewed as a positive outcome.

Assuming the maximum 8% annual raises, Reid’s salary for next season will increase to $21.6 million. This places Minnesota approximately $33 million below the second luxury tax apron, even accounting for team options on forward Josh Minott and center Luka Garza. This financial space might be sufficient to bring back Randle, whose 2025-26 option carries a $31 million cap hit. However, retaining both Randle and Alexander-Walker, who is expected to command a salary near or at the non-tax midlevel exception, now seems improbable without additional trade activity.

It is understandable that the Timberwolves might prioritize their two prominent big men, especially after drafting guards Rob Dillingham and Terrence Shannon Jr. in the recent first round. Minnesota also has Jaylen Clark, a 2023 second-round pick who showed defensive promise in his rookie season after missing the entire 2023-24 season due to injury. Additionally, the Timberwolves are securing Reid through his prime years; he will turn 26 in August and will be 30 by the time this five-year contract concludes. Despite these factors, there remains doubt about whether Reid is truly a starting-caliber player, even after winning the Sixth Man award in 2023-24.

A bench role generally suits Reid better due to his defensive limitations. These were particularly exposed when he played primarily at center last season after Minnesota traded Karl-Anthony Towns. Lineups featuring Reid at center had a defensive rating of 116.3 last season, significantly worse than the 103.0 rating when he played power forward. This is an important consideration when projecting Reid as a potential eventual replacement for Rudy Gobert at center.

With the introduction of the second apron and stricter penalties for teams with large luxury tax bills, overpaying key contributors has become more financially punitive than ever before. While Reid has been an essential component of the Timberwolves teams that reached the conference finals in the past two seasons, paying him like a starter will necessitate sacrifices down the line. Given the market dynamics, it appears Minnesota could have secured a more team-friendly contract.

June 25: VanVleet to sign new $50 million deal with Houston

![]()

Grade: A

Fred VanVleet has reportedly agreed to a two-year, $50 million contract with the Houston Rockets, a deal that will replace his $44.9 million team option for 2025-26. This agreement appears to be a result of either Houston effectively leveraging its position or demonstrating a willingness to spend even more substantially in the future.

It is certainly true that VanVleet would have faced difficulty in finding a better offer on the open market. Legally, only the Brooklyn Nets had the necessary cap space to potentially exceed this offer. This meant that for VanVleet to secure a larger contract elsewhere, potentially with a contender as an unrestricted free agent, Houston’s involvement in a sign-and-trade would have been required. However, these limited market conditions apply to virtually all notable free agents this summer, making it unlikely that other teams will achieve similar contractual bargains.

Consider, for comparison, that VanVleet is projected to earn less next season than Kyrie Irving, who will begin the year rehabbing a torn ACL. While Irving benefited from the leverage of a player option on his previous contract for 2025-26, he still added more new money ($76 million over the two years beyond 2025-26) than VanVleet did in his new deal.

It’s possible VanVleet could potentially recoup some of that difference down the line, as his new contract includes a player option for the 2026-27 season. Houston is currently hard-capped at the second luxury-tax apron due to aggregating salaries in the Kevin Durant trade. This restriction might not be in place a year from now, potentially allowing the Rockets to re-sign VanVleet to a larger, longer-term contract in a summer where other teams might have ample cap space to pursue him.

For the immediate future, securing VanVleet at a starting salary approximately $20 million less than his previous option provides Houston with access to its non-taxpayer midlevel exception. In a market where likely only the Nets will have more spending power, this positions the Rockets as a significant player for a notable free agent to complement Kevin Durant and their young core.

Nickeil Alexander-Walker emerges as a likely target for Houston, as he fits the profile of a perimeter player who has proven capable in a playoff rotation, having done so for the Minnesota Timberwolves in consecutive conference finals appearances. Gary Trent Jr.`s shooting ability also makes him a suitable fit. Ty Jerome would offer good value but might be somewhat redundant with the role the Rockets envision for 2024 No. 3 overall pick Reed Sheppard.

Regardless of who Houston targets, the ability to utilize the full midlevel exception is crucial. It should help Houston address the slight depth reduction resulting from the Durant trade and strengthen the team’s standing as a championship contender.

June 24: Kyrie Irving declines player option

![]()

Grade: B+

Kyrie Irving declined his $43 million player option for the 2025-26 season ahead of the Tuesday deadline. Instead of exercising the option, he will sign a reported three-year, $119 million extension with the Dallas Mavericks, effectively adding two years and $76 million to his existing contract.

The Mavericks held a degree of leverage in negotiations due to the limited market resulting from a trade involving the Brooklyn Nets, which potentially meant no other team could legally offer Irving as much money in free agency. (Practically speaking, the prospect of the rebuilding Nets bringing Irving back just three years after trading him to Dallas could be politely described as a long shot.)

At the same time, Irving could have chosen to pick up his option and target free agency next summer, when he might have been able to command a higher annual salary and certainly a longer-term contract. This reported extension appears to represent a fair compromise for both sides.

Reducing Irving`s starting salary in the new deal to around $37 million has significant implications for the Mavericks` financial flexibility this summer. This structure leaves them approximately $7 million below the second luxury-tax apron with 13 players already under contract, not including a team option for backup point guard Brandon Williams.

Had Irving chosen to pick up his previous option, Dallas would likely have been restricted primarily to offering minimum contracts to fill out the roster, barring a salary-shedding trade. With the new deal, the Mavericks now potentially have access to the taxpayer midlevel exception. This allows them to sign a free agent ball handler, which is a critical need as Irving is expected to miss a substantial portion of the 2025-26 season while recovering from the ACL tear he suffered in March.

June 23: Mavs` Gafford gets three-year extension

![]()

Grade: Pass (extensions for non-free agents graded on a pass/fail basis)

Daniel Gafford has reportedly agreed to a three-year extension with the Dallas Mavericks. The timing of this extension is arguably the most interesting aspect, as conventional wisdom suggested Gafford could be a trade candidate this summer, given the Mavericks` crowded depth chart at the center position. Youngster Dereck Lively II is seen as the future starter, and starting power forward Anthony Davis is also capable of – and perhaps best suited for – playing the center position.

There is little doubt that Gafford has earned a raise coming off the best season of his NBA career. He excelled defensively in a platoon system with Lively as Dallas reached the 2024 NBA Finals. Gafford received an opportunity for extended minutes between the time Lively went down with a stress fracture in January and his own knee sprain in February.

During 11 full games in that specific stretch, Gafford averaged 15.0 points per game on 67% shooting, 10.3 rebounds per game, and 3.6 blocks per game. His blocking average during this period would have challenged Victor Wembanyama (3.8 BPG) for the league lead. Although typically functioning primarily as a finisher on offense, Gafford even demonstrated the ability to create from the post when the team was dealing with multiple injuries. His 52 post-ups last season were a career high, according to tracking data, although his efficiency on those plays was not particularly strong.

Beyond the potential limitations on Gafford’s role with the Mavericks, a trade now also makes sense from the team`s perspective because this could represent the peak of his performance. Gafford will turn 27 in October, and while his size and strength will remain, his effectiveness as an above-the-rim threat might diminish as he approaches his 30s.

Based on these factors, it was important for Dallas to structure the extension carefully. The deal reportedly features a maximum 20% raise in the first year (a starting salary around $17.3 million) followed by 5% annual raises, ensuring it complies with the restrictions on extend-and-trade deals. By staying within these parameters, the Mavericks retain the flexibility to trade Gafford as soon as the extension is officially signed, or hypothetically, even before then.

Having Gafford under contract for an additional three seasons should not negatively impact his trade value; in fact, it likely makes him more attractive to potential suitors. This extension reportedly pays him only slightly more than the projected 2026-27 non-taxpayer midlevel exception ($15.5 million), and Gafford has consistently provided value well exceeding that figure thus far in his career. From Gafford`s perspective, securing his deal a year in advance successfully removes injury risk from the equation. Thus, this move can be considered a win-win.

The next question is which teams might be interested in acquiring Gafford. He appears to be an obvious fit for the Los Angeles Lakers, having shown comfort running pick-and-rolls with Luka Doncic, although that idea might provoke an adverse reaction from already sensitive Dallas fans. Gafford would also be a sensible target for the guard-heavy Phoenix Suns, though finding workable matching salary could be challenging unless the Suns manage to get below the second apron. If the New Orleans Pelicans are not fully convinced that Yves Missi is ready to be a starting-caliber center at this stage of his development, Gafford would represent a significant offensive upgrade. Other potential wild-card possibilities include a return to Gafford’s original team, the Chicago Bulls, and the San Antonio Spurs.

Of course, the Mavericks may simply decide to keep Gafford. After all, they spent a significant portion of the second half of last season with none of their three starting-caliber centers fully healthy, highlighting the value of having reliable depth at the position. Furthermore, it would be challenging for another potential contender to offer the specific perimeter help that Dallas is seeking, meaning a trade involving Gafford would most likely need to be a complex, multi-team deal.

June 14: Rockets, Adams agree to three-year extension

![]()

Grade: B

The 2025 NBA offseason officially got underway with the Houston Rockets and Steven Adams reportedly agreeing to a three-year, $39 million contract extension, even while the NBA Finals were still being played. While teams are generally not permitted to negotiate new contracts with their own free agents until after the Finals conclude, they can sign extensions with eligible players in the final year of their contracts at any point up to June 30.

Adams, acquired by the Rockets at the 2024 trade deadline while still recovering from season-ending PCL surgery, initially served as a veteran presence and mentor for a young team, as well as a backup to All-Star center Alperen Sengun. His role expanded significantly during the playoffs, where lineups featuring both Adams and Sengun surprisingly became key contributors to Houston pushing the Golden State Warriors to the distance after falling behind 3-1 in the series.

Whether playing alongside Sengun or serving as the sole center on the floor, Adams reached a performance level in the playoffs not seen since earlier in his career. He averaged 1.9 blocks per 36 minutes, surpassing his best regular-season mark (1.7). Additionally, his 60% shooting was a notable improvement from his 55% during the 2024-25 regular season. An evaluation using the wins above replacement player metric rated Adams as the team’s fourth-most valuable player in that series, ahead of starters Dillon Brooks and Jalen Green.

Given that the size and strength that make Adams a dominant offensive rebounder are enduring physical attributes, the kind of agility and defensive impact he demonstrated against the Warriors will make him a valuable player for the Rockets, provided he remains healthy. Before the PCL injury that caused him to miss the 2023 playoffs and the entirety of the 2023-24 season, Adams had been remarkably durable, playing 76 out of 82 games in 2021-22. Houston will undoubtedly be careful with Adams’ workload. Although he was cleared to play both games of back-to-back sets midway through last season, the Rockets continued to rest him in one of the games, citing his recovery needs after playing the previous night.

Bringing back Adams on a contract worth approximately $13 million annually – slightly less than the $14.1 million non-taxpayer midlevel exception that other teams could have realistically offered – will push Houston towards the luxury tax threshold, particularly if the team exercises Fred VanVleet’s $44.9 million team option. Even if the Rockets waive two players with non-guaranteed contracts (Jock Landale at $8 million and Nate Williams at the minimum), they would still likely edge over the lower luxury tax apron after filling out the rest of the roster in that scenario.

Alternatively, Houston could decline VanVleet’s option and attempt to re-sign him to a smaller starting salary on a longer-term contract that would guarantee him more money as he enters his early 30s. This decision could be influenced by other potential moves the Rockets might have planned. Houston`s tax situation makes it seem improbable that they will add a free agent earning more than the $5.7 million taxpayer midlevel exception, but the Rockets could pursue more substantial roster upgrades via trade.

According to reports, Houston has until June 29 to make a decision regarding VanVleet’s player option. Barring a major blockbuster trade, VanVleet is almost certainly expected to return. This means Adams’ new contract positions the Rockets to potentially bring back the entire core of the team that secured the No. 2 seed in the Western Conference.